The Truth About Debt Service Coverage Ratio (DSCR): How It's Actually Calculated

- DSCR shows if your business makes enough to comfortably cover upcoming loan payments.

- A DSCR above 1 means you have a safety cushion; lenders usually want 1.15–1.25+.

- It’s calculated using net operating income, not profit, and lenders often adjust the numbers differently.

- Strong DSCR can improve approval odds and get you better rates, while a weak DSCR signals higher risk.

- Some lenders skip DSCR entirely if your SBSS score is high enough (typically 200+).

When it comes to business loans, one of the most important numbers lenders look at is the Debt Service Coverage Ratio (DSCR). Yet, despite its importance, many small business owners misunderstand what it really means and how it’s calculated. Today, we’re breaking down DSCR in simple terms and explaining why it matters for your SBA loan or commercial financing.

FastWay SBA Tip: We always check SBSS before calculating DSCR. The reason is that not all banks require DSCR as part of the underwriting model, for example if the SBSS score is over 200, DSCR may not be used in underwriting.

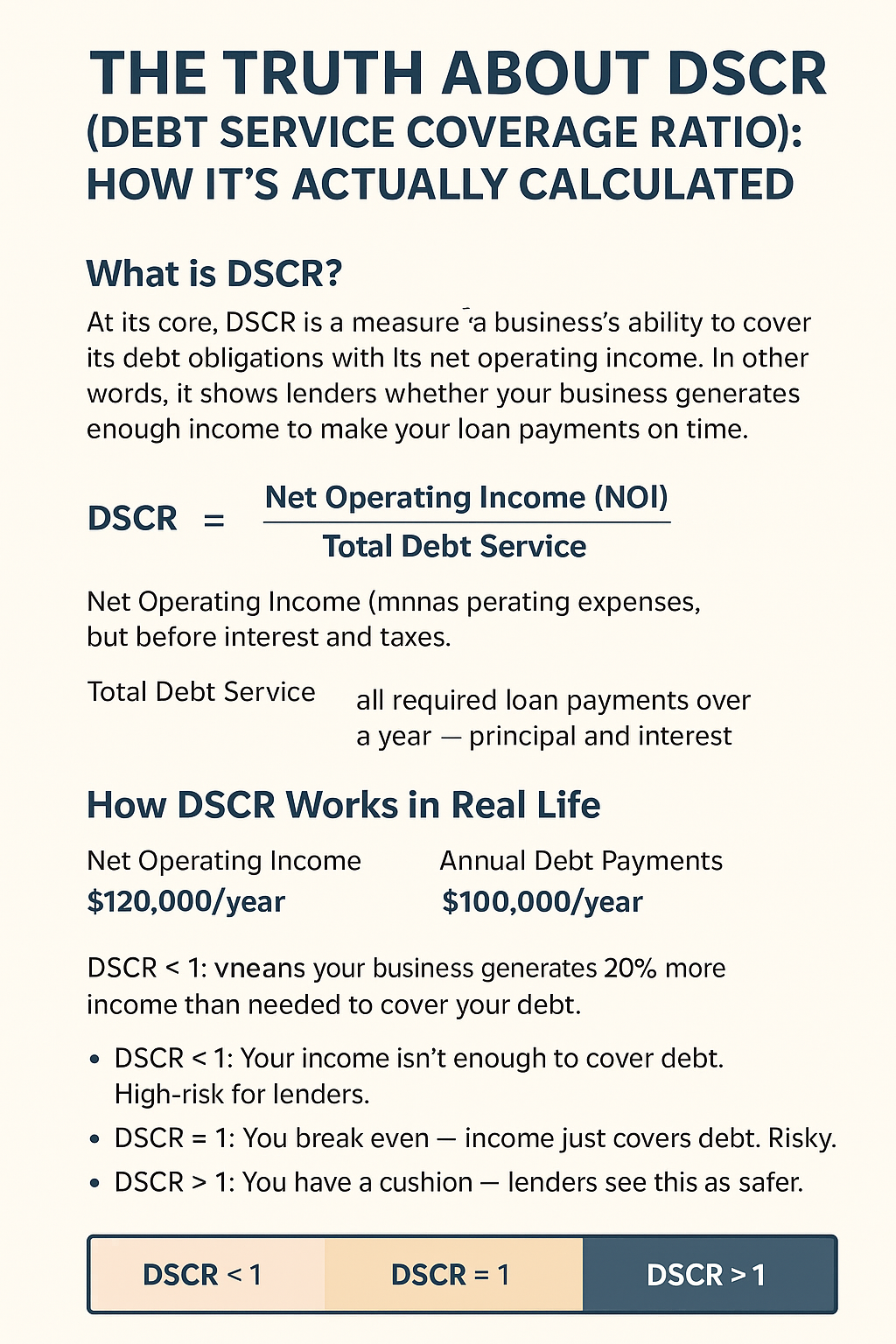

What is DSCR?

At its core, DSCR is a measure of a business’s ability to cover its anticipated loan debt obligations with its net operating income. In other words, it shows lenders whether your business generates enough income to make your anticipated loan payments on time. The lender wants to ensure that the business will be able to cover expected loan payments.

DSCR Formula:

Net Operating Income (NOI): This is your business revenue minus operating expenses, but before interest and taxes.

Total Debt Service: This includes all required loan payments over a year - principal and interest.

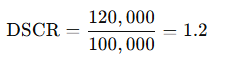

Example of How DSCR Works

Here’s a simple example:

- Net Operating Income: $120,000/year

- Annual Debt Payments: $100,000/year

A DSCR of 1.2 means your business generates 20% more income than needed to cover your debt. Lenders typically look for a DSCR of 1.25 or higher, depending on the type of loan and risk profile.

DSCR < 1: Your income isn’t enough to cover debt. High-risk for lenders.

DSCR = 1: You break even — income just covers debt. Risky.

DSCR > 1: You have a cushion — lenders see this as safer.

Common Misconceptions About Debt Service Coverage Ratio (DSCR)

- It’s not your profit: DSCR is based on net operating income, not net profit. Non-cash expenses like depreciation may be excluded. Depreciation is a discounted tax liability accounting method.

- Lenders calculate it differently: Some lenders adjust NOI to exclude one-time income or expenses, giving a more realistic picture of repayment ability.

- Higher isn’t always better: While a higher DSCR shows safety, it can also indicate higher approval amounts - your business might be able to take on more debt to fuel growth.

- DSCR Not Always Required: Some lenders do not require a DSCR analysis if the business scores over a certain SBSS.

Why DSCR Matters for SBA Loans

For SBA 7(a) loans, DSCR is a key underwriting metric:

- SBA 7(a) loans: Typically require a DSCR of at least 1.15, this is determined by the bank. Each bank has a minimum required DSCR for approval.

Meeting the DSCR requirement doesn’t just help you qualify — it can also secure better interest rates and terms.

Tips to Improve Your DSCR

- Increase net operating income: Boost revenue, reduce operating costs, or streamline expenses.

- Refinance high-interest debt: Lower payments improve your debt service ratio.

- Delay new debt: Avoid taking on additional loans until your DSCR is strong.

- Consider a larger down payment: Reduces debt service and increases DSCR.

DSCR Not Always Required

DSCR may sound complicated, but at its core, it’s a simple measure of whether your business can cover anticipated debt payments. By understanding how it’s calculated and what lenders are looking for, you can position your business for better financing terms and smarter borrowing decisions. One of the many benefits of working with FastWaySBA is our vast knowledge of which banks will approve your business based on your business’ DSCR.

.png)